The 3-Minute Rule for "Common Misconceptions About Mortgages for Pensioners, Debunked"

Obtaining a mortgage loan as a beneficiary can be challenging, but it is feasible. There are actually various possibilities accessible to pensioners who really want to purchase a property or re-finance their existing home mortgage.

To start with, it's essential to comprehend that financial institutions take into consideration many factors when figuring out whether to accept a mortgage app. These elements consist of profit, credit background, and debt-to-income ratio. As a pensionary, your earnings might be lesser than when you were working full-time, which could create it even more challenging to qualify for a home mortgage.

Having said that, there are some possibilities readily available that may help you secure a mortgage as a beneficiary. One possibility is to use for a reverse mortgage. This kind of loan makes it possible for you to obtain against the equity in your property without possessing to create month-to-month settlements. Rather, the funding is repaid when you market the home or pass away.

An additional option is to apply for an interest-only mortgage. With this type of lending, you simply pay out the enthusiasm on the funding each month and not the main amount acquired. This may help lower month-to-month remittances and help make it easier for pensioners with minimal incomes to train for mortgage loans.

It's likewise worth looking at downsizing your current residence or acquiring a much smaller residential or commercial property outright with cash if achievable. This can easily relieve up funds that can be utilized in the direction of paying out off any existing financial obligations or improving your savings.

If you possess excellent credit and sufficient profit from sources such as pension plans or investments, typical mortgage loans may still be available provided that you comply with various other qualification requirements established through financial institutions.

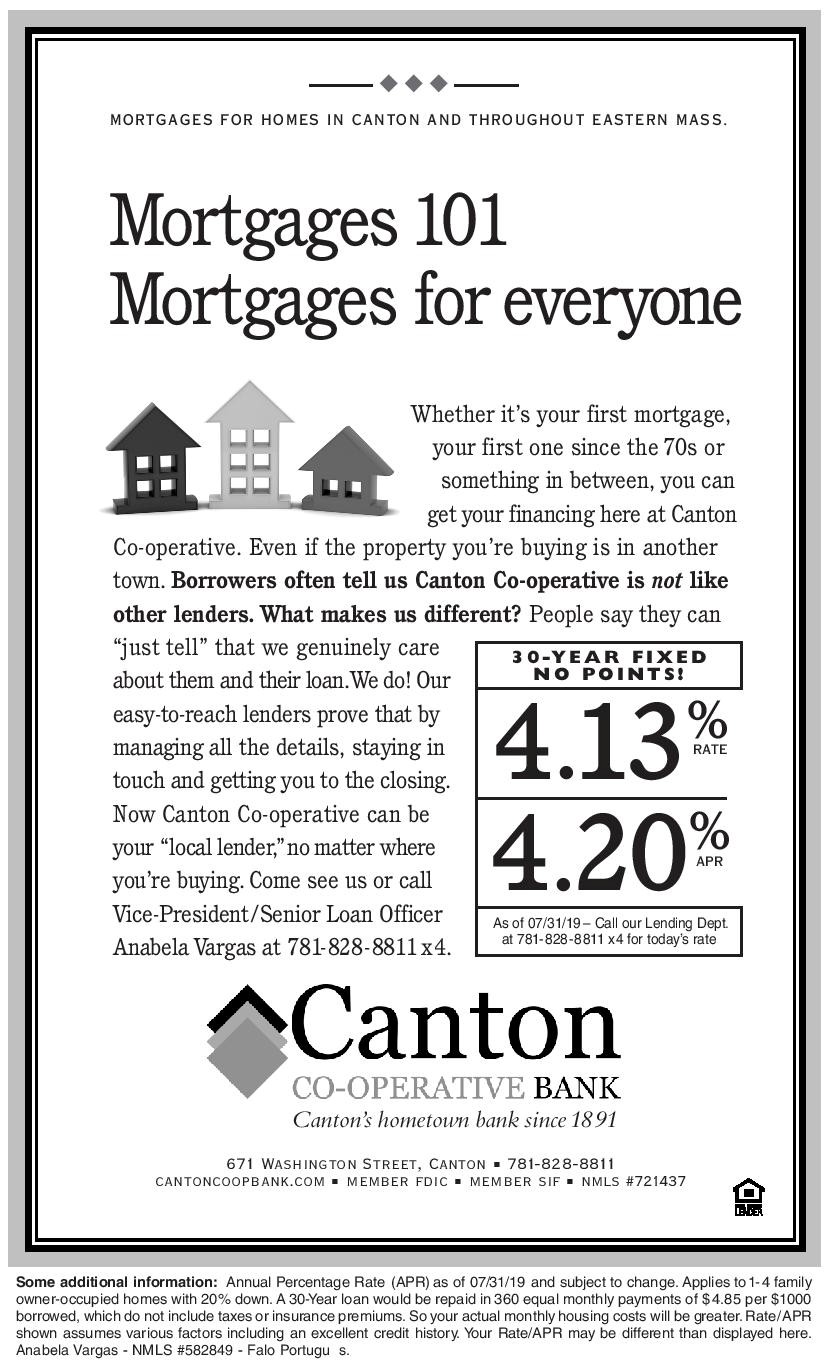

When administering for any type of kind of home loan as a beneficiary, it's significant to shop around and contrast offers coming from various loan providers properly. You should additionally look for specialist financial assistance just before producing any type of major economic choices such as taking out a new funding or re-financing an existing one.

In enhancement to taking into consideration these choices discussed above, there are actually various other steps that beneficiaries can take to enhance their chances of getting authorized for home loans:

1) Enhance your credit scores credit rating: A really good credit history rating is crucial when using for a home loan. If your credit scores credit rating is reduced, think about taking steps to enhance it, such as paying out off financial obligations and making sure that all expenses are spent on time.

2) Spend down existing financial debts: High levels of personal debt can impact your capability to certify for a mortgage loan. If feasible, spend off any excellent financial obligations just before administering for a new loan.

3) Work along with a specialist financial institution: Some creditors focus in delivering mortgages to pensionaries and may have additional flexible qualification criteria.

In final thought, obtaining a home mortgage as a pensioner may be challenging but not difficult. There are actually numerous options readily available such as reverse mortgages or interest-only mortgages that can help pensionaries get lendings. This Website to carry out your analysis and find professional guidance before producing any major financial decisions.

To start with, it's essential to comprehend that financial institutions take into consideration many factors when figuring out whether to accept a mortgage app. These elements consist of profit, credit background, and debt-to-income ratio. As a pensionary, your earnings might be lesser than when you were working full-time, which could create it even more challenging to qualify for a home mortgage.

Having said that, there are some possibilities readily available that may help you secure a mortgage as a beneficiary. One possibility is to use for a reverse mortgage. This kind of loan makes it possible for you to obtain against the equity in your property without possessing to create month-to-month settlements. Rather, the funding is repaid when you market the home or pass away.

An additional option is to apply for an interest-only mortgage. With this type of lending, you simply pay out the enthusiasm on the funding each month and not the main amount acquired. This may help lower month-to-month remittances and help make it easier for pensioners with minimal incomes to train for mortgage loans.

It's likewise worth looking at downsizing your current residence or acquiring a much smaller residential or commercial property outright with cash if achievable. This can easily relieve up funds that can be utilized in the direction of paying out off any existing financial obligations or improving your savings.

If you possess excellent credit and sufficient profit from sources such as pension plans or investments, typical mortgage loans may still be available provided that you comply with various other qualification requirements established through financial institutions.

When administering for any type of kind of home loan as a beneficiary, it's significant to shop around and contrast offers coming from various loan providers properly. You should additionally look for specialist financial assistance just before producing any type of major economic choices such as taking out a new funding or re-financing an existing one.

In enhancement to taking into consideration these choices discussed above, there are actually various other steps that beneficiaries can take to enhance their chances of getting authorized for home loans:

1) Enhance your credit scores credit rating: A really good credit history rating is crucial when using for a home loan. If your credit scores credit rating is reduced, think about taking steps to enhance it, such as paying out off financial obligations and making sure that all expenses are spent on time.

2) Spend down existing financial debts: High levels of personal debt can impact your capability to certify for a mortgage loan. If feasible, spend off any excellent financial obligations just before administering for a new loan.

3) Work along with a specialist financial institution: Some creditors focus in delivering mortgages to pensionaries and may have additional flexible qualification criteria.

In final thought, obtaining a home mortgage as a pensioner may be challenging but not difficult. There are actually numerous options readily available such as reverse mortgages or interest-only mortgages that can help pensionaries get lendings. This Website to carry out your analysis and find professional guidance before producing any major financial decisions.

Created at 2023-05-27 20:38

Back to posts

This post has no comments - be the first one!

UNDER MAINTENANCE